Nez Perce County property tax bills are a shock

Homeowners are getting quite a surprise when their 2022 bill comes in the mail; changes made by the Idaho Legislature appear to be the culprit

As soon as he saw his assessed value notice this past June, Rod Smith knew there was a good chance his property tax bill would be going up in the fall.

Based on last year’s strong real estate sales, Nez Perce County estimated the market value of his Lewiston home had nearly doubled, from about $198,000 to almost $389,000.

Higher assessments don’t always translate into higher property taxes, but Smith was prepared for a 15% or 20% increase in his tax bill. Maybe even 30%, something he and his wife had seen before in the 14 years they’ve owned their home.

Instead, their taxes jumped by $2,700, or 67%.

“In the past, I’ve complained about a 20% increase,” Smith said. “Once you see that a couple of times, it’s not a huge deal. But 67%? That was shocking.”

Homeowners all across Nez Perce County — and all across Idaho — had similar shocks. Ever since the tax notices went out a few weeks ago, they’ve been calling the assessor’s office and local lawmakers, demanding explanations and asking what the Legislature is going to do to address the problem.

“I’ve had little old ladies call me up crying on the phone,” said Rep. Lori McCann, R-Lewiston. “Their property taxes are going up over $200 a month, and they don’t have it. They don’t know what they’re going to do. I don’t know what the answer is, but we (the Legislature) need to do something.”

Adding to the confusion and anger is the fact that many commercial and agricultural property owners actually saw their property taxes go down this year — in some cases by tens of thousands of dollars.

So how is that possible? How did residential property owners get stuck with the short end of the stick, and what can be done about it?

How we got here

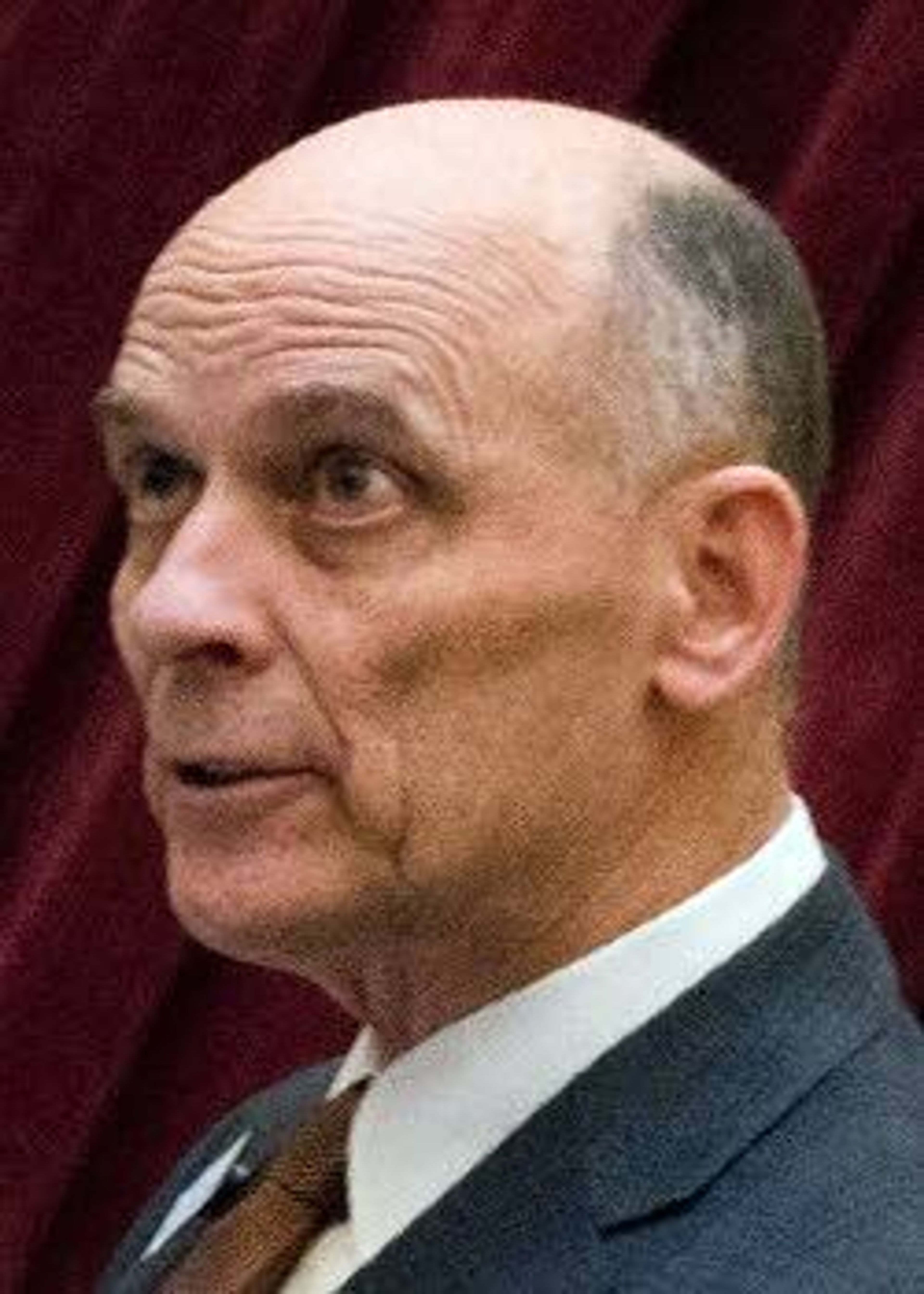

Nez Perce County Assessor Dan Anderson said the problem dates back to 2016, when the Legislature modified the homestead exemption.

The exemption reduces the assessed value of a primary residence by 50%, or $125,000, whichever is less. Since the assessed value is used to calculate property taxes, this lowers a homeowner’s tax bill.

Prior to 2017, the value of the exemption was tied to the Idaho Housing Price Index. That meant it went up or down every year, depending on what happened with overall home prices.

When the index was in place, the homestead exemption ranged as high as $104,471 in 2009 and as low as $81,000 in 2013. Many lawmakers — and their constituents — found that variability hard to swallow. Consequently, the Legislature ditched the House Price Index in favor of a fixed exemption amount. They initially capped it at $100,000, and subsequently raised it to $125,000 in 2021.

That decision, which came just as home prices began their steep upward trajectory, had an immediate and long-lasting negative effect on homeowners.

According to the Idaho State Tax Commission, if the Housing Price Index were still in place, the homestead exemption would have risen from $101,610 in 2017 to nearly $225,000 this year — almost $100,000 more than allowed under the statutory cap.

For Nez Perce County homeowners, a $100,000 reduction in assessed value would save them anywhere from $500 to $1,800 in property taxes this year, depending on where they live.

“That’s why our office is telling people to contact their legislators and ask them to make the homeowners exemption a priority (in the 2023 legislative session),” Anderson said.

Where does all the ‘extra’ money go?

No everyone’s tax bill went up 67%, like Smith’s, but pretty much every class of residential property in the county ended up seeing an increase.

When people hear that, Anderson said, they naturally wonder where all the “extra” money is going.

The reality, though, is that there isn’t any extra money. Neither Lewiston nor Nez Perce County, for example, took much of an increase in their fiscal 2023 property tax collections. Lewiston actually cut its property tax budget a slight amount, from $23.69 million to $23.31 million. Nez Perce County saw a slight increase, from $19.38 million to $19.51 million, but the difference was entirely because of new construction.

Because property tax collections stayed flat while the tax base expanded, Lewiston’s 2023 property tax levy dipped to 0.669%. Nez Perce County’s dropped to 0.387% — its lowest level since 2002.

The reason homeowners didn’t see a corresponding decrease in their taxes, Anderson said, is because residential properties as a whole saw a 41% increase in assessed values this year. All other property types combined saw about a 4% increase.

Imagine a scenario where the county has a $4 billion property tax base, split evenly between residential and all other types of property, including commercial and agricultural.

Now imagine the county has a $75 million property tax budget.

Dividing $75 million by $4 billion yields a property tax levy of 1.875%. Multiply that by each property’s assessed value, and homeowners collectively end up covering half the property tax bill, or $37.5 million. The remaining property owners pick up the other half.

The next year, because of strong home sales, residential assessments increase by 40%, from $2 billion to $2.8 billion. All other property types increase by an average of 4%, from $2 billion to $2.08 billion.

The property tax budget stays the same, so the annual levy rate drops to 1.537% ($75 million divided by the new tax base of $4.88 billion).

However, given the uneven increase in assessed values, residential properties now accounts for 57% of the total tax base, instead of 50%. Homeowners end up covering $43 million of the property tax budget, while the commercial, agricultural and other property owners together pony up just under $32 million.

The county didn’t collect any more money, but $5.5 million in property taxes shifted from commercial and agricultural to residential.

In a nutshell, that’s what happened in Nez Perce County this year. Because of the huge increase in residential assessments, residential properties went from 53% of the total tax base in 2021 to 61% this year. They paid more, business and agriculture collectively paid less.

And the bad news, Anderson said, is that the residential market stayed strong through the first half of 2022, so that shift could get even bigger next year.

“It’s possible there will be a further increase in (residential) assessed values,” he said. “The next assessment notices go out in June of 2023, and by law we’re required to use 2022 sales (to estimate market values).”

What can the Legislature do?

There are only a few ways to address the problem.

First, local governments could cut spending and reduce the amount of property tax revenue they need.

That option has long been a favorite of newly elected House Speaker Mike Moyle, R-Star, who can point to a number of Treasure Valley communities that, in his opinion, waste taxpayer dollars.

The Legislature as a whole, though, has done little to reduce the services that counties are mandated to provide. Until they do, local government officials say there’s little they can do to cut spending.

A second option would be to increase the homestead exemption and possibly tie it to the Housing Price Index once again.

McCann said lawmakers will likely look at doing that this session, but it’s a temporary fix. It shifts the tax burden back onto commercial and agriculture, but doesn’t reduce the reliance on property tax revenue.

“It’s a Band-Aid fix, but it’s something we might have to do until we can look for a longer-term solution,” she said.

A third option would be to replace some or all property taxes with another revenue source.

Former Sen. Jim Rice, R-Caldwell, proposed such a solution at the end of the 2022 legislative session. His plan would have eliminated all local property taxes on owner-occupied homes, except for voter-approved bonds and supplemental school levies.

Commercial, agricultural and industrial properties would continue to pay local property taxes, but the taxes previously paid by residential homeowners wouldn’t shift onto other classes of property.

“On average, it would lower property taxes by about two-thirds. In some areas it’s higher. I think the lowest (reduction) is 50-plus percent,” Rice said in February.

In order to replace the lost revenue, the bill would have increased the state sales tax from 6% to 7.95%. That was a sticking point for many lawmakers, which is why Rice pulled the bill.

Rice, who served as chairperson of the Senate Local Government and Taxation Committee, was defeated in the May Republican primary, so he won’t be in position to reintroduce the legislation.

However, Sen. Scott Grow, R-Eagle, the new co-chairperson of the joint budget committee, recently told the Idaho Press that he’s working on legislation that dedicates 10% of state sales tax receipts to property tax relief.

Sales taxes are a primary source of state general fund revenues, which are used to pay for public schools and all other general government services.

Other options for help

Under state law, county commissioners have the ability to cancel property taxes if they cause undue hardship for the property owner.

There’s also a “circuit breaker” program for certain lower-income individuals, which provides up to $1,500 in annual property tax relief.

The application deadline for 2022 has already passed, but applications for 2023 taxes will be accepted from Jan. 1 to April 17. The program is open to people 65 and older, as well as widows and widowers, those who are disabled or blind, former prisoners of war and mother- or fatherless children under the age of 18.

Their annual income, excluding certain medical or funeral expenses, can’t exceed $33,870. The assessed value of their home also can’t exceed 150% of the county median, or $300,000, whichever is greater.

Rep. Charlie Shepherd, R-Pollock, sponsored legislation this year raising the assessed value cap to 150%, up from 125%. He said it may need to be raised again, but he and other lawmakers would resist eliminating the cap altogether because they don’t think people with million-dollar homes should be getting tax breaks.

Finally, Idaho also has a tax deferral program where homeowners can defer property taxes indefinitely. The taxes, plus interest, would all be due when they die and/or when there’s an ownership change for the home, or when it no longer qualifies for the homestead exemption.

More information on the circuit breaker and tax deferral programs is available from the county assessor’s office, or online at tax.idaho.gov/taxes/property/homeowners/reduction.

Spence may be contacted at bspence@lmtribune.com or (208) 791-9168.